social security tax calculator

Enter your expected earnings for 2022. Enter your filing status income deductions and credits and we will estimate your total taxes.

Taxable Social Security Calculator

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

. Enter total annual Social Security SS benefit amount. For security the Quick Calculator does not access your earnings. Social Security calculators provided by other companies or non-profits may provide proper suggestions if they were built with extreme care.

If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000. Financial advisors can simply enter the benefit amount and taxable income into Social Security Timings calculator and it will compute the taxable benefits. Benefit estimates depend on your date of birth and on your earnings history.

Between 25000 and 34000 you may have to pay income tax on. Social Security Taxes are based on employee wages. IRS Form 1040 lines 1 2a 2b3a3b4b5b78.

Box 5 of any SSA-1099 and RRB-1099 Enter taxable income excluding SS benefits. If you have a lot of income from other sources up to 85 of your Social Security benefits will be considered. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator.

Combined Income Adjusted Gross Income Nontaxable Interest 12 of Social Security benefits. The social security tax calculator will show you your total social security tax for this year. There are two components of social security taxes.

Social Security Quick Calculator. If your income is above that but is below 34000 up to half of. The tool has features specially tailored to the unique needs of retirees receiving pension.

The Old-Age Survivors and Disability Insurance program OASDI taxmore commonly called the Social Security tax is calculated by taking a set percentage of your. How to compute taxable part of social. Withhold the percentage from the employees gross taxable wages and contribute your half based on the employees gross taxable wages.

This means that regardless of how much money a person earns anyone who earns at least 147000 will pay a. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. For security the Quick Calculator does not access your earnings.

Benefit estimates depend on your date of birth and on your earnings history. Social Security Quick Calculator. The 1993 Social Security Amendment set the start of the 85 taxability of your benefits at 34000 for a single individual and 44000 for a married couple.

Earnings above this level of income are not subject to social security tax. Social Security taxes have a wage. If your combined income is above a certain limit you will need to pay at.

Are Social Security Benefits Taxable. Income Tax Calculator. To calculate the social security tax enter your income and number of dependents.

Use the calculator below to know the amount if your social security benefit that you must include in the tax return as taxable income. Based on your projected tax withholding for the year we can also estimate.

Social Security Tax Calculator Are Your Retirement Benefits Taxable Fox Business

2023 Fica Calculator Calculate Social Security And Medicare Contributions

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Bland Garvey Cpa Social Security Pension Income Tax Calculator Richardson Tx

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Federal Income Tax Calculator Estimator For 2022 Taxes

Social Security Tax Impact Calculator Bogleheads

Tax Withholding For Pensions And Social Security Sensible Money

Tax Witheld Calc Clearance 55 Off Ilikepinga Com

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Solved Ebook Show Me How Calculator Calculating Social Chegg Com

Are Your Social Security Benefits Taxable Capital Strategies Inc

Tax Calculator Estimate Your Income Tax For 2022 Free

Taxcalculator Twitter Search Twitter

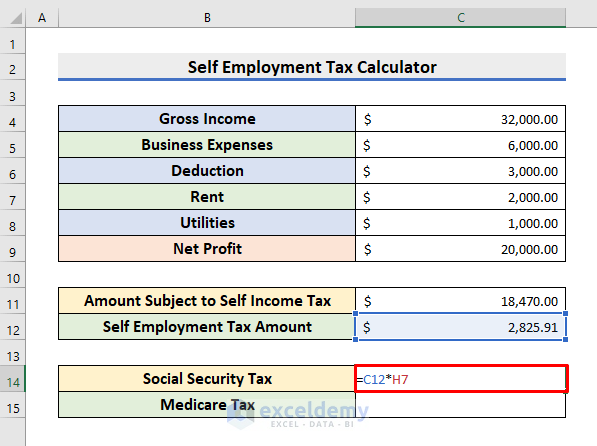

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)